Before you start reading this post: Check out IP Sync, my most recent startup, if you’d like notifications when the static IPs for important websites change. In any case, enjoy this blog post!

Hey 👋

Hey there, I’m Ben, the founder of Mockernut Ventures! MV is the holding company for all of my indie startup ideas and what this blog is named after. Why do I have a holding company? Well, I quit my full-time job at a big tech company a few months ago and committed to building 12 startups in 12 months and needed an umbrella to cover all of those businesses.

This is my third month in the 12 month journey of startup creation. With that, I hope you enjoy this post about month 3 of building startups!

An interview? Say what?

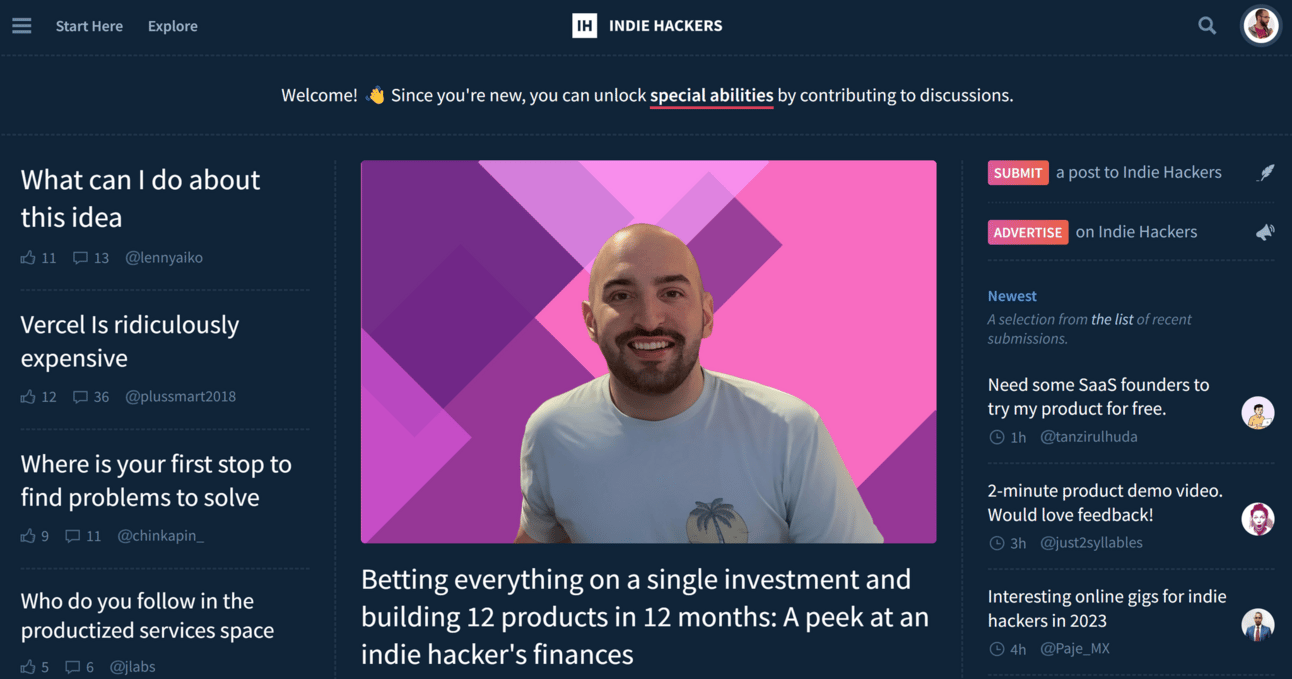

Yes, you read it right - this month I managed to land an interview with IndieHackers about my startup journey.

It’s me on the front page of IndieHackers.

Thanks to my buddy AJ for sending me this screenshot!

If you haven’t heard of IndieHackers, it’s a community of makers motivating each other to ship bootstrapped products and a news site all in one. It’s also been a valuable resource for me for a long time, and some of my heroes in the indie developer community got their start there, so it was quite surreal to wake up and see my mugshot plastered on the frontpage of IndieHackers.

To be fair, I expected to be featured on the site somewhere, but I didn’t expect to be on the front page with the biggest possible article format.

That definitely made my morning.

How I Landed the Interview

You might be wondering how I managed to get this kind of interview without any successful products in the market. Well, read on and let me tell you.

I’d like to say that my products are so cool that people noticed them and wanted to interview me without me saying anything, but the actual story is that a simple misunderstanding/stroke of luck led to this interview!

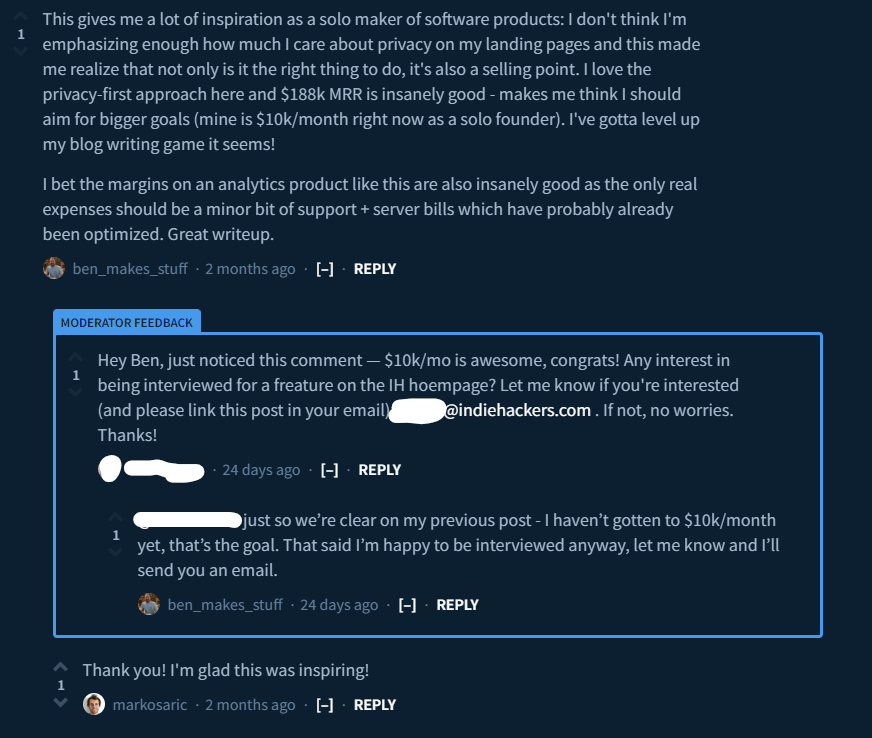

The gist of it is that I had randomly commented on another maker’s blog post about launching a privacy-first product just to show appreciation for the post, and a moderator reached out as he also randomly happened to stumble across my comment — he thought, based on what I had written, that I was already doing $10k/month in revenue (I wish!) when in fact I had just tried to get across that my goal was $10k/month.

I was tempted for a second to respond to him and say “yeah, I’m totally at 10k/month” in the spirit of “fake it till you make it” to get the exposure, but I always feel the right thing to do is to be honest in situations like this which is what I ended up doing:

How I responded to the moderator comment

When I didn’t get a response from the moderator after leaving the comment, I followed up via email. Anyone in sales knows that being able to follow-up is one of the most important skills to have as a salesperson, and it certainly proved to be the case here.

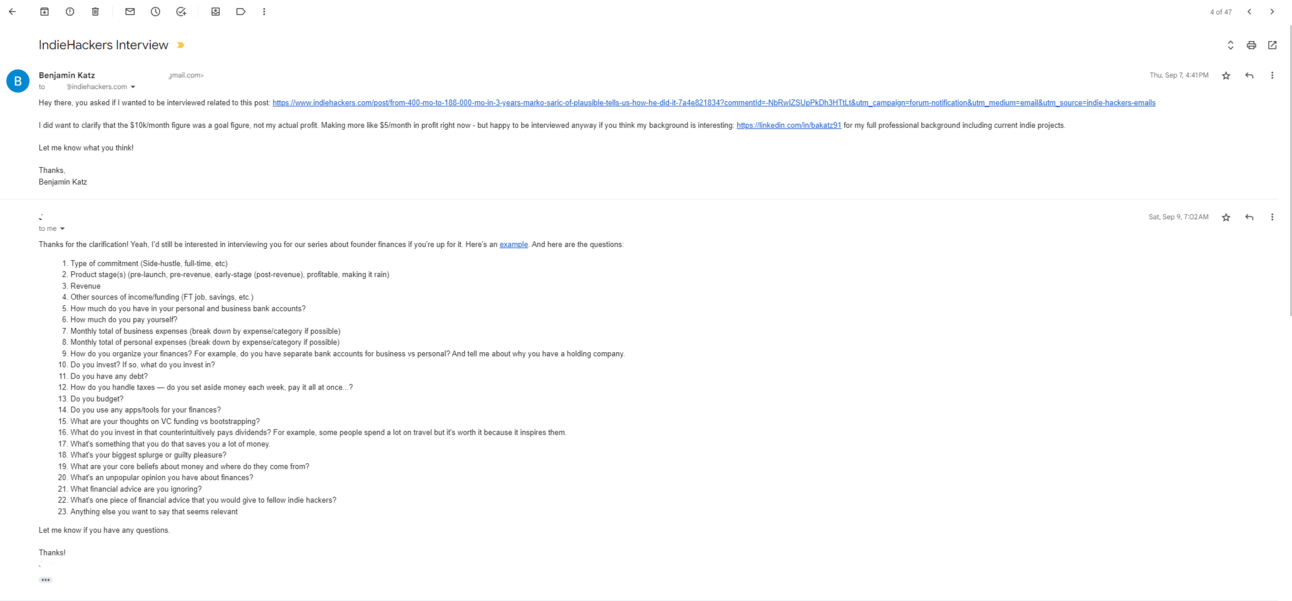

If he still hadn’t responded to email, I would have waited a few days and sent another followup email - but, lucky for me, he responded on his own with a long list of interview questions for me to answer:

You might have to tap on the image to expand the email thread if it isn’t visible enough on your screen.

After a few back-and-forths where I filled out all of the questions, had him ask me more questions to get more details, and then asked him to make some edits, the moderator sent me an email back to confirm that the interview was live on the website!

One tip for getting interviewed: make sure you ask the writer/reporter for a copy of the interview article before it gets posted so that you make edits as necessary. Sometimes, writers and reporters embellish or include details you’d rather not be published and it’s a lot better to catch these sorts of errors beforehand vs. after the article is already live.

This was definitely the case here, as the author’s original writing style was a bit weird, and some of the sentences came across as robotic. He was very open to feedback and fixed it with a second round of edits, so I’m glad that I was able to ask about it before he hit the publish button.

The Raw, Unedited Interview

Speaking of edits, the article you see posted on IndieHackers is missing some details and is reworded to be in the third person which is not how I answered the questions.

As such, I thought I’d post the raw, unedited interview here as it includes some extra details you won’t find on IndieHackers. Here it is in its full, unedited glory — enjoy:

Type of commitment (Side-hustle, full-time, etc)

Full-time! I quit my job as a Staff Software Engineer at a big tech company a few months ago to build my own projects full time as a solo maker. Currently building 12 startups in 12 months until something sticks. And, if I have anything to say about it, I’ll never go back to working for a company.

Product stage(s) (pre-launch, pre-revenue, early-stage (post-revenue), profitable, making it rain)

Just launched https://ipsync.link (notifications when static IPs change) as of a couple days ago: pre-revenue

https://simpleotp.com (passwordless authentication SaaS): pre-revenue

https://dynamicduo.gg (game server for the video game Rust): post-revenue

https://printswarm.com (3d printing as a service): post-revenue, but I shut it down after realizing it wasn’t the type of business that I wanted to run long term

https://which.name (TBD): I bought this domain name without really knowing what to do with it. However, I think it’s a cool domain name and it’s short, so let me know if you want to buy it!

Revenue

$5/month 🥲

Other sources of income/funding (FT job, savings, etc.)

$1,535/month from bond payments (fixed)

$1,277/month from stock dividends on average (sometimes more)

$317/month from bank interest payments

To cover the rest of my expenses, I withdraw from my investment portfolio once per year (see below)

How much do you have in your personal and business bank accounts?

$75k in my personal bank account

$250 in my business bank account as reserves. My monthly business spend is basically $0 at the moment (AWS free tier + got approved for $5k in AWS credits for the next 2 years) so I don’t need much at all in my business bank account.

How much do you pay yourself?

Since I don’t have any monthly business related expenses and I expect to receive an income tax refund this year, I’m basically taking out 100% of whatever revenue is coming in and transferring it to my personal bank. I haven’t eaten into the $250 in reserves yet.

I don’t have sales tax to worry about since I use a merchant-of-record (MoR) as my payment processor, so I don’t need to set any money aside to remit sales taxes either.

Monthly total of business expenses (break down by expense/category if possible)

I have absolutely zero in monthly business expenses since I’m using the AWS Free Tier and have the $5k in AWS credits as a backup. I also got the domain for my latest business for free because my business bank was doing a promotion with NameCheap at the time.

In terms of yearly expenses, I pay $100/year for a game server (for the $5/month in revenue business) and $39.95 in domain renewal fees for all of the domains for the different business ideas I have. Planning on downgrading the game server and therefore paying 50% less next time it renews to make it profitable.

Monthly total of personal expenses (break down by expense/category if possible)

Rent: $3,200 and this is unfortunately on the low end for a 1 bedroom in the center of my current city

Health insurance: $585

Utilities: $150

Food & Entertainment: $1,400

How do you organize your finances? For example, do you have separate bank accounts for business vs personal? And tell me about why you have a holding company.

Yes, I separate business and personal expenses with different bank accounts and different login credentials. I think it’s super important to keep personal stuff separate from business stuff for legal liability reasons, and just to make accounting easier. It’s easier to see how much your business expenses are when they’re all in one place and you don’t have to filter through your personal bank account transactions to see what is business related vs. personal. You can just look at your business bank account and know that every transaction is related to the business.

I formed a LLC as a holding company for the same reason: I don’t want to mix personal and business, and I want legal protection in case someone tries to sue for whatever reason. Without an LLC, a bad actor can go after your personal assets in a lawsuit which I definitely want to avoid. Also, in general, forming a holding company as a LLC (or equivalent) makes a lot of sense if you’re experimenting with a bunch of different ideas like I am. LLC paperwork at least where I live takes a lot of time, money, and energy - so it’s best to just go through this process one time and spread the legal risk across all of your businesses. In general, whenever there’s a new business, it just gets added to the same holding company instead of being a separate company.

My main goal with the above legal setup is to have the simplest possible structure that gives me a minimum amount of legal protection and also allows me to operate as easily as possible. This structure also allows me to file one set of tax forms each year and not deal with the complexities of running an offshore business in the beginning.

Do you invest? If so, what do you invest in?

Yes, I’ve always been interested in investing. My investments are mainly in stocks and bonds. For stocks, I mostly invest in Vanguard total market ETFs, but I also have some concentrated positions where I think it’s appropriate. For bonds, I invest in both US Government Bonds and small business loans.

In general, I strongly prefer passive investments and given that I’m likely moving somewhere else within the next few months to lower my expenses, I’m not a fan of real estate. I also contribute 10% of my net worth to “risky” investments. For me, this ends up being 5% of my portfolio in crypto (even split of BTC, ETH, LTC) and 5% in angel investments through Angel List.

Do you have any debt?

Zero debt other than the usual credit card balance which I pay off in full every month. I also pay off early if I notice that there’s more than say, a couple thousand dollars, on all of my credit cards combined.

How do you handle taxes — do you set aside money each week, pay it all at once...?

I used to do my own taxes and pay it off all at once, but after my portfolio got a bit more complex I started pay a licensed CPA to deal with it once per year. I see that as a worthwhile expense as it saves me an ungodly amount of time (I have 25 different angel investments with long Schedule K-1 forms not to mention stocks and other investments, and entering and checking all of that data manually takes an entire weekend if I’m to do it on my own)

Do you budget?

Yes, although not to an extreme extent. I look at my expenses every month in Personal Capital and see how much I’m spending and to make sure my personal burn rate is still on track for the year.

Regarding burn rate, I’m using the 4% rule (really being even more conservative than that and withdrew less than that last year) to withdraw money from my stock portfolio as needed to cover living expenses.

Do you use any apps/tools for your finances?

Personal Capital/Empower to monitor my net worth, Fidelity for stock trading, Coinbase for crypto.

For anything related to finance, I try to use very well known tools that have been around for 10+ years and have a good reputation in terms of security. I also avoid products like Robinhood that have had multiple controversies or significant outages even if they’re slightly easier to use or have lower fees.

What are your thoughts on VC funding vs bootstrapping?

I’d say that I have a healthy distaste for authority (and VC money), so bootstrapping is the way to go for me. I did some soul searching about this recently and realized that I’m the happiest when I get to have complete creative freedom and not have to answer to anyone except the customers of my product.

What do you invest in that counterintuitively pays dividends? For example, some people spend a lot on travel but it's worth it because it inspires them.

Travel and motorcycling (I don’t own one anymore, but I like to rent when I’m in a new country) are big ones for me because I find that the best way to get startup ideas is to travel and experience new things in general. Pieter Levels, one of my inspirations for indie hacking, has a great talk about this where he recommends doing new things as a way to figure out what to build next, and I couldn’t agree more. In the past, I actually came up with a business idea related to motorcycling (I had a motorcycle safety website a while ago that made a bit of revenue) just by becoming interested in the hobby and learning more about it than the average person.

The latest business I built is an authentication company, and even if no one pays me for it, all of my business ideas need an authentication flow. Instead of paying a 3rd party company thousands of dollars per month at scale to handle authentication, I’m able to use my own service and pay very little to keep it online. In the short term, I spent a month building this product, but in the long run, this should save me a lot of money.

Working out and physical fitness: sometimes it’s hard to step away from a difficult problem before it’s solved, but I find that when I’m stuck on a particularly hard problem or there’s something I can’t figure out, picking up a heavy thing and putting it back down a few times does the trick. Working out pays dividends both in terms of mental health and physical health, so it’s a no brainer to lift weights as an entrepreneur even if it doesn’t directly contribute to business results.

What's something that you do that saves you a lot of money.

Besides applying for AWS credits and spending as little as possible on server bills, can I cheat a bit and say what I’m going to do in the next few months to save myself a lot of money? If so, my expenses are quite high at the moment because I live in one of the most expensive places in the world: NYC. Given that I want to be able to indie hack for as long as possible, I applied for a residence visa in another country which will lower my living expenses by ~65-70%. Point being: I’ll do whatever it takes to extend my time building businesses, including leaving the US if necessary.

What's your biggest splurge or guilty pleasure?

I really don’t buy a lot of “things” other than food and drinks and I’m very disciplined when it comes to not splurging on random consumer goods or elecronics, but I’m a mechanical watch nerd and I bought myself a “luxury” watch a couple years ago. To be fair, the watch market went a bit nuts during 2020-2021 and I did research ahead of time to know which brands/models had the best chance of appreciating. So, this one was both a guilty pleasure and a lucky investment - the value of the watch went up by 50% after I bought it, so it ended up making financial sense to buy it as well as it being a splurge.

What are your core beliefs about money and where do they come from?

I have a few:

Don’t lose money

Don’t buy things that depreciate in value

Be greedy when others are fearful (especially if you know something that others don’t)

I think most of this was ingrained into me from a young age. My parents were extremely frugal with money and taught me to respect and invest it properly. I remember being 13 years old and sitting down with my dad to learn about P/E ratios, how to value companies, and other concepts related to the stock market - probably an unusual activity for a 13 year old but it helped me later in life.

For the third one about being greedy when others are fearful: I know this to be true after experiencing it for myself. A few years ago, I had the opportunity to exercise a bunch of stock options at a startup I was working at — or put a down payment down on a house. Everyone told me to buy the house and that startups were too risky. However, I knew something others didn’t because I was working at the startup: sales were exploding, leadership was making all of the right moves leading to high morale, and business was absolutely taking off. I knew that I might not get another chance to invest in a “rocketship” type of business, so I drained my entire bank account to exercise 100% of my stock options, didn’t buy the house, and ended up making a huge return on my investment when the company went public a couple years later.

What's an unpopular opinion you have about finances?

When trying to build wealth, diversification beyond a certain point is overrated. I’d rather own 20 great stocks than 2,000 mediocre ones.

What financial advice are you ignoring?

“Real estate is a great investment” - I won’t deny that there are unique tax benefits to real estate investments and property values generally go up over time, but I don’t want to deal with tenants, termites, and toilets (or giving up 10%+ of my rental income to a property manager). Stocks do better on average anyway in terms of appreciation, and for fixed income I’d rather invest in US government and other bonds for completely passive income. With US government bonds, there are tax benefits so it can often be similar to real estate in that way.

What's one piece of financial advice that you would give to fellow indie hackers?

Don’t be afraid to go all-in on something (a business, an investment, or anything else that you think has a chance to generate a huge return) if you have the chance to do so, especially if you’re young, and have time to rebuild your portfolio if things don’t turn out the way you hoped them to.

Anything else you want to say that seems relevant

Check out my 2 newest startups: https://ipsync.link, https://simpleotp.com

Follow my Twitter/Twitch if you’d like to see the process of startups getting built in public! https://twitter.com/ben_makes_stuff and https://twitch.tv/ben_makes_stuff

I blog about the process of building startups here and also cover some of the financials involved: https://ben-makes-stuff.beehiiv.com/

Followups

Why will you never go back to working for a company?

Okay, to be fair, I never really say never about anything, but I very much enjoy working for myself and don’t want to do anything else. The short of it is that I’m a creative person and I find that building a business solo is the best form of creative freedom I’ve ever had. When working for a company, even a small startup with 2 employees, there will always be some kind of manager/CTO telling you what to work on next, you’ll have to ask for approval to take time off, and so on. I’d rather make those calls myself (with customer input of course with respect to the stuff to work on)

How much runway did you have when you left your job?

I saved up several years of runway before quitting. I did this primarily because:

a) I know that a lot of popular businesses that took off took multiple years to get to true product-market-fit

b) I’ve known more than a few people that quit to run a startup with almost no runway (they had ~6 months or less), then had to sheepishly ask for their old job back or take contracting work/odd jobs which distracted them from running a business when they ran out of money. I never want to be in that position.

c) I don’t want to work with VCs and have a general sense of distrust for the profession. They’re not all bad, but I like setting my own goals and don’t have a problem holding myself accountable, plus software businesses are cheap to operate - so I don’t see any reason to take money upfront. The only reason I would do that is if I felt financially insecure or didn’t have enough runway.

Why did you decide to go all-in on indie hacking? And why did you decide to do a 12x12?

Four reasons:

I’ve always had an itch to build startup ideas. This started from a fairly young age when I built a web hosting reseller business at 16 out of my parents’ house and made a few hundred dollars. That was huge money in high school and it sort of flipped a switch in my brain where I then had an urge to work on more startups - but I took a (long) detour to go to university, work several software engineering jobs to get better at my craft, learn about different mistakes/good ideas other business owners had while starting their respective tech startups, and save up money. I’m really happy I took the extra time to learn more things at the end of the day and don’t regret doing that at all, but I also realized it was time to move on recently for a few reasons (see the remaining 3 reasons below)

Some time in the last year, I watched an old talk by Pieter Levels/@levelsio which was super inspiring: https://www.youtube.com/watch?v=6reLWfFNer0. Highly recommend watching this! Pieter is basically in the Olympics of indie hacking if you look at his profit numbers which he posts on his twitter bio - I want to get there some day. I believe he was also the first person to publicly try the 12 startups in 12 months thing, and this video/some of his other twitter content inspired me to do the same.

There’s a famous Jeff Bezos quote about “regret minimization” that resonated with me - I realized that I didn’t want to be on my death bed wishing that I had gone after a dream of building my own business ideas, but instead had worked a job that I wasn’t completely satisfied with just because it was the “safe” option.

My mental health was suffering. I was finding myself struggling to get out of bed most days of the week because I was dreading going to work, and one day a few months ago, after a particularly long week of meetings that completely drained me of any energy that I had left, I went to sleep, woke up the next morning and realized “Hey, wait a minute. I’m clearly not enjoying my job anymore, and I have enough money saved. Why don’t I just go after what I’ve always wanted to do and try starting some startups until something works?” I submitted my resignation the following week.

Which product is generating $5/mo?

https://dynamicduo.gg - players pay for VIP subscriptions to get colored usernames and special Discord access. It used to do a whopping $15/month, but a few players stopped playing the game (and I think the game is generally waning in popularity) so now there’s only one person paying $5. That one person: you know who you are, I appreciate you! 🙂

Why didn't you want to run printswarm long-term?

I wrote an entire blog post discussing this here: https://ben-makes-stuff.beehiiv.com/p/month-1-beginning — at a high level, I already spent 7 years of my life working on logistics software, and I realized once I got into the weeds of the printswarm business that I’d end up needing to build the exact same thing with this idea. Also, I anticipated a bunch of legal/support problems that would be painful for a solo founder to deal with at scale that I outlined in the blog post. Give it a read if you’re interested in my thought process here!

Tell me more about your bond payments and stock dividends. How does that work? And those are pretty big - how much do you have invested?

I invest in small business bonds through https://thesmbx.com (SMBX is very high risk as you can imagine as they deal with small business bonds, but certain bonds I invested in that are no longer available on the marketplace are paying me a 30%+ of my money back each month — not all of that is interest) and very safe US Government bonds paying ~5% in interest every month (these government bond rates won’t last forever of course, interest rates are variable)

Again, note that the majority of this payment is principal from SMBX and not interest which is why the payment looks a bit high. The actual amount I’ve made on top of my original investment is lower.

I don’t feel comfortable giving out how much exactly I have invested, but in terms of percentages, I generally follow the “your age as a % in bonds” rule for knowing how much to allocate. That percent is mostly allocated to the safe US government bonds (Treasury Bills)

How did you get approved for $5k in free credits? How can others do the same?

I did some research on completely free (no fee) small business banks when I was setting up the LLC, and Mercury had this as one of their perks. Sign up, then just click the “Perks” menu (it’s under your profile tab at the bottom left of the screen) after you get approved and log in.

How did you save up $75k?

I worked as a Software Engineer at a big tech company that paid me about $12k/month in base salary after taxes + 401k contributions. From that $12k, I saved $6k or more each month and it took me around a year to get to $75k doing that. I also did a couple of short term consulting calls over the course of the year which made up a few hundred dollars of that $75k.

Why do you expect an income tax refund?

I worked for my previous employer until May, and while I got my usual paycheck + stock grants until then, I used Tax Loss Harvesting with $VTI ↔ $SCHB to generate enough of a loss (the market was in the dumps at the time, so most of my tax lots were at a loss) to offset any capital gains taxes I would otherwise have to pay. Also, my business isn’t making enough money to impact my taxes at this point - $5 in MRR and all 🙂

What do you include as "Entertainment" expenses?

Bars, restaurants, movies, concerts - roughly equal split between all of them except movies which I rarely go to. I live in New York City so I do like to spend more on all of the amazing food/entertainment options around here and go out to meet friends vs. doing too much cooking at home.

Where are you living right now?

New York City

So do you bother incorporating your new products or do you have DBAs or do you just pretend like they're one business?

They’re all under one legal entity (one LLC), and I just create a DBA for each new idea if said idea is expected to do sales in the near future. The DBAs are associated with the LLC, not with me personally.

Tell me more about your "concentrated positions".

This was really a reference to the stock options I was able to exercise (all in one private company), and that sometimes taking on concentration risk by exercising stock options early is appropriate if you happen to work at the company as you can see how it operates, giving you an advantage over people that don’t work there. Note: this is not a suggestion to trade stocks on insider information such as internal company financials as that’s against the law in the US for both public and private companies. Don’t do that. You might want to consider exercising early however if you think the company is going to do well over the next few years as there are tax benefits if you happen to be right. Talk to a tax advisor before doing something like this, it can get complex.

*The way stock options work at startups is that you have to pay to exercise them at a certain fixed price (the current private market valuation of the company dictates the price) - then you can only sell them much later upon a liquidity event like an IPO which is what I was luckily able to do a few years later when the IPO was unexpectedly announced right before it was supposed to happen (they do that on purpose to avoid people leaking information or violating the law/doing insider trading)

Why do you pay off credit cards early if they're over $3k?

I like to have a very high credit score at all times in case I decide want to apply for a loan or anything like that, and it’s also important to be able to rent an apartment (my lease is up soon). Having very low “credit utilization” by maintaining a near zero balance is one way to boost your score along with paying on time every month and in full.

How much do you have invested as an angel? And in crypto?

Not comfortable sharing exact amounts.

In terms of percentages: both of these are very risky and speculative and I don’t want to encourage people to lose their money. I only put in 5% of my net worth at the time into crypto and 5% to angel investing and stopped once I hit those thresholds for that reason.

There are a few sites you can use to invest in startups without significant net worth requirements:

What is your net worth? And how did you get to that level — was it all thanks to the stock options at the startup that you mentioned?

Not comfortable sharing my exact net worth. Let’s say the exit is one of the things that allowed me to quit my job confidently and move onto what I really wanted to do the whole time: indie hacking.

Exercising stock options and selling when the time was appropriate did improve my net worth, but I wouldn’t have been able to do that had I not been disciplined and consistently saved money. The lesson here is to save 50% of your income or more and do that for years on end. Then, when the timing is right and you have some money to play around with, invest in something that has a chance to make a significant return (like your own startup or exercise stock options at a startup you’re working at).

How much did your watch cost?

$5,900 - most expensive single purchase of a “thing” I’ve ever made in my entire life! I also have insurance that covers it in case it gets lost/stolen. Plan on keeping it forever.

Please send me a photo of yourself, a screenshot of any revenue graphs if applicable and links to your socials.

Socials:

Check out my 2 newest startups: https://ipsync.link, https://simpleotp.com

Follow my Twitter/Twitch if you’d like to see the process of startups getting built in public! https://twitter.com/ben_makes_stuff and https://twitch.tv/ben_makes_stuff

I blog about the process of building startups here and also cover some of the financials involved: https://ben-makes-stuff.beehiiv.com/

Rev graph from PrintSwarm before I shut it down:

Rev graph for DynamicDuo.gg for the past year (right click → view original):

19. You seem to know a lot about investing. What is your advice to beginner investors? What can they do to build wealth quickly?

For beginner investors, I would really just suggest long term thinking and not being in too much of a hurry to make trillions of dollars.

The most important thing you can do when you’re getting started with investing is to get a high paying job or start a startup that does significant revenue so that you have money to invest in the first place.

Being wealthy means different things to different people, that said, once you have money to invest: concentration and taking calculated risks, always with some degree of speculation, is one way to build wealth quickly. However, I would suggest concentration only in scenarios where you have some kind of advantage and to exercise caution as these are scenarios where you can easily lose your entire investment. Here are a few examples of times you might consider a concentrated investment either in time or in money, or both:

It’s your own company that you’ve founded in a niche that you completely understand and ideally you have enough savings to hold you over for a few years. In this scenario, consider quitting your job and not necessarily going “all in” financially in terms of putting all your money in the company, but at least dedicating 100% of your time to the company for a few years and seeing what happens.

You work at a startup and know they’re growing quickly, morale is high, you like the management team, and the next few years seem like they could be promising given the market for the product. I’m not saying to use any material non-public information like internal company financials and trade shares on the secondary market (that would be insider trading, don’t do that), but consider exercising any stock options they’ve given you early, or otherwise not selling any shares you’ve received for a few years to realize their full potential/some kind of IPO or public acquisition event if you’re reasonably confident something like that might happen. Wait for a few years and see what happens.

A friend starts a company and asks for angel investments. Similar situation as #2 as these are very illiquid investments and you will need to wait years to see a return on your money - you also better know the founders and the market extremely well before making an investment.

Until Next Month

I hope you enjoyed the interview! See you again this time next month - this month, I’m working on an idea in the AI space which should be exciting for all developers that deal with large codebases.

If you’d like to hear about that, be sure to subscribe and you’ll get a notification next month when I write about it! Cheers.